The 7 Best Personal Finance Apps

Budgeting your money may be one of the least enjoyable things ever. And let’s be honest: most of us are much better at spending than we are at saving. Nonetheless, it’s still important; after all, it’s not often you hear someone say, “Darn, I budgeted too well this month,” or, “I wish I hadn’t saved so much money.”

Luckily, there are a number of apps out there to make the process of budgeting not just easier, but also kind of fun. Here are seven of the best personal finance apps—saving, earning, and managing your money is about to get so much better. :-)

1. Digit

SMS bot that monitors your bank account & saves you money

Digit may just be one of the simplest money-saving tools you’ll ever use. Securely connect your bank account, and Digit will analyze your spending and income to help you put away small amounts of money that you don’t need for your bills or day-to-day expenses. Every few days, money (usually somewhere between $5–50) will get transferred from your checking account to a Digit savings account. They promise not to take out money you’ll actually need, so you don’t have to worry about overdraft fees. And, all you have to do to get your money out of the savings account and back into your checking account is send a text message. Simple as that.

2. Spendee

Analyze your finances by category, person, or location

If you don’t want to connect your bank account to a budget tracking app, Spendee is for you. The app has a beautiful, easy-to-use interface that will make you actually want to track your expenses with it. Since it’s not synced to your bank account or credit cards, you have to manually add in all of your income and expenses. But, if you’re willing to put in the effort and track your spending, this app actually enables you to analyze your spending more accurately than most of the automated personal finance apps out there.

Spendee can go hand-in-hand with some of the other apps on this list. You still have to do the work of figuring out how you want to tweak your spending, but it makes you conscious of where your money is going—and likely, more thoughtful about what you spend money on in the first place.

3. Prism

Keep track of your bills, all in one place

You get paid once or twice a month—but your bills are due sporadically. Keeping track of your recurring bills can be a huge pain; especially if some of them can’t be automated. Enter: Prism. This app automatically organizes all of your bills in one place, giving you a quick view of your account balances and due dates.

The set up takes a few minutes—you have to connect each of your accounts individually—but once that’s done, Prism will sync all of your account bills and balances automatically. You can set up due date notifications and pay your bills right from the app so you never miss a payment again. Your credit score will be pretty happy about this.

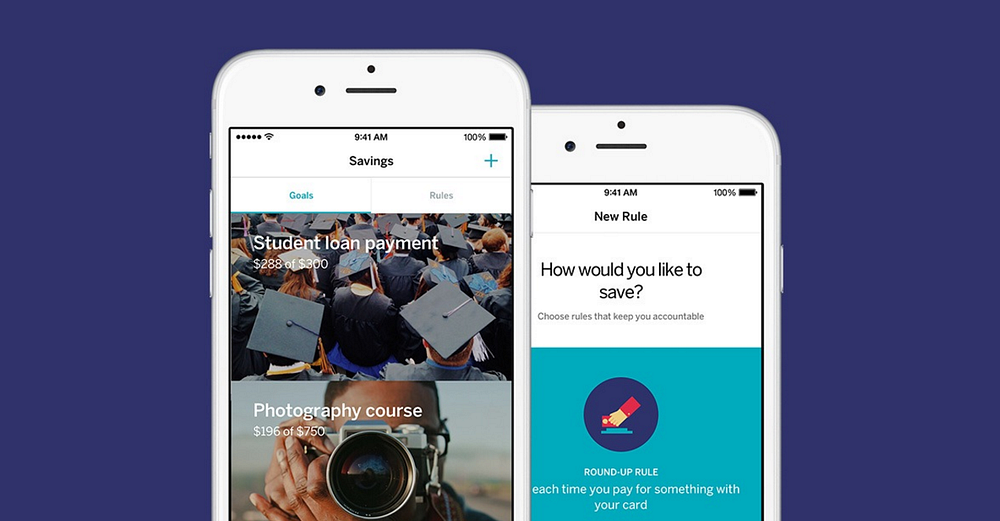

4. Qapital

Reach your financial goals with gamified automatic savings

Similar to Digit, Qapital uses the automatic savings approach, regularly setting aside small amounts of money you don’t need for bills or day-to-day expenses. The biggest difference is that, with Qapital, you have a little more flexibility to define particular savings “rules” and “triggers.” For example, you can: round up the change on each purchase; save whenever you spend less than your budget; save when you buy things you’re trying to cut back on; set aside 30% for taxes every time you get paid (a freelancer necessity!); or save a fixed amount daily, weekly, or monthly.

The set-up process is super easy. First, create a savings goal and choose a rule or trigger for automated savings. Next, open a free FDIC-insured savings account through Qapital. Finally, link your bank account to transfer money to and from your savings account based on the rules you’ve got set up. Simple as that! We see a celebratory debt-free trip to Costa Rica in your future…

5. Hello Money

Design your own portfolio from 24,000+ funds and stocks

The apps listed up until this point are all about managing your personal finances. Hello Money, however, is designed to help you make more money. The idea is simple: Wouldn’t it be great to pick and choose different funds and stocks to create our ultimate portfolios one piece at a time—kind of like LEGOs? Hello Money allows you to do just that. Currently, the platform allows you to pick and choose from over 24,000 different funds and stocks, and they are adding new ones every day.

If you aren’t a savvy investor, this app may not be very intuitive at first. Nonetheless, it’s a fun way to get to know the market and better understand investment strategy. We recommend using Hello Money to get a peak at how others are investing their money, experiment with how different holdings influence your returns, and improve your financial portfolio.

6. Sweep

Automatically save for your goals with bank to bank transfer

If you’re looking for a savings app that focuses on helping you get ahead of your bills and savings goals so you don’t have to keep re-doing your budget, Sweep may just be the perfect pick. You can set up various “buckets” (e.g. bills, credit cards, vacation, rainy day fund, student loans, home, etc.) and set aside money to make sure you’re paying and saving whatever you need to hit all of your financial goals each month.

The main goal of Sweep is to help you plan your finances in advance and automatically save for each of your goals with simple bank-to-bank transfer. One of the cool things this app does is let you know whether your bills are impacting your savings goals, and vice versa. This is a great tool to help you build up financial awareness around your spending, saving, and goal-setting—and ensure that you’re planning for the future in advance so you have all the money you need for any big purchases up ahead.

7. You Need a Budget (YNAB)

Budgeting software to help you pay off your debt, save more money, and break the paycheck-to-paycheck cycle

You Need a Budget (YNAB) has been around for a while, but is so well-loved by those who use it, we couldn’t not include it. This software is extremely intuitive and easy to use. YNAB goes beyond being just a tool to track your finances, keep on top of bills, and set savings goals. It’s built around a four-step plan:

- Give every dollar a “job” in advance

- Save for a rainy day

- Address overspending before moving into the next month

- Live on last month’s income (no more paycheck-to-paycheck nonsense)

If you’re looking for more of a lifestyle change when it comes to how you budget, spend, and save your money, YNAB is the combo plan + software to try.

8. I Will Teach You to Be Rich

6 weeks to stress-free, no-guilt money management

This one isn’t an app, but it is a must-read finance book. There are a number of useful and popular personal finance reads out there, and it’s hard to know where to start. I Will Teach You to Be Rich is a great one if you’re new to personal finance and/or have tried other plans that haven’t quite worked for you. Author Ramit Sethi walks you through a six-week, no-bullshit approach to getting your finances in order and laying down the tracks for a sound financial future. The six-week plan includes:

- Optimizing your credit cards (make them work for you)

- Beating the banks (no more paying for stupid fees)

- Getting ready to invest (open your first—or a better—investment account now)

- Spending consciously (making budgeting less boring)

- Saving in your sleep (it’s really possible)

- Investing like a boss (spend an afternoon now, make your money work harder for you forever)

This book is the kick-in-the-ass you need to get your finances together, and the advice offered throughout goes nicely with the budgeting and saving tools listed above.

If you’re looking for more great budgeting apps, you can find them in this collection on Product Hunt: